Affordable healthcare, insurance and prescriptions are a hot topic in American culture. With one medical emergency or unexpected illness, many find themselves buried in unintelligible medical bills, and are left feeling helpless, confused, and sometimes thrust into financial ruin.

You’d be hard-pressed to find many people who are happy with the current American healthcare system. It’s become a- seemingly- unstoppable beast.

But, how did we get here? What does the machine actually entail? And what can we do now to avoid being eaten by this monster?

Knowledge is power, so understanding the mechanisms and levers of this system is where we’ll start…

Part I: When America Got Health Insurance

The story of America’s health insurance system begins at the turn of the 20th century. Before any real medical advancements, patients rarely went to the doctor, and routine “check-ups” weren’t in the public’s vernacular.

“Medical care” consisted of radioactive drinking water, poisonous mercury, cocaine-laced sodas and cigars…

But as the 20th century progressed, so too did medical advancements. Scientific understanding made leaps and bounds, as did physicians’ training and knowledge, medical tools upgraded and hospitals became more sanitary.

But still, most people only visited the doctor under extreme circumstances: In the grips of pain, illness or pregnancy.

As so many hospital beds lay empty, a worker at the Baylor Hospital in Dallas, Texas conceived of a way to finance hospitals: Have future patients pay $0.50 per month continuously, and when they needed a service, they could use the hospital “free” of charge.

The idea initially sprung from a behavior he noticed: Women would spend a few cents to a dollar monthly on cosmetics without noticing how much they’d spend over time… Why not do the same with healthcare?

And so he did.

Initially, the Baylor hospital focused on women, promising them an easy birthing experience when the time came; All women who paid into the Baylor hospital system would utilize the hospital for “free”, with no extra bill after giving birth.

When the Great Depression hit and decimated businesses, the Baylor hospital remained. The small monthly payments from future patients had helped them stay afloat. Other hospitals took notice and began to implement similar systems.

Still, regular healthcare and doctor’s visits were not part of mainstream culture, but medical care and the still-new health “insurance” would see a surge when World War II demanded heightened production and workers in factories. In order to recruit and keep factory workers, employers began offering health insurance.

In the early 1940’s, the Internal Revenue Service (IRS) made employer-paid health insurance tax-free, giving more incentive to employers to offer this to employees. In the following decades, employer-offered health insurance took hold in America, with employees often expecting it in benefits packages.

And remember the Baylor hospital? It became Blue Cross.

Starting as an ingenious idea to get more patients in hospital, the Baylor model has now become a five-headed, monolithic beast of epic proportions…

Part II: The Healthcare System Today

Many Americans, when asked, can’t explain the inner workings of the current healthcare system.

Sure, we know we’re getting the short end of the stick, that we’re being taken advantage of, but we don’t know the beast with which we’re dealing.

When pressed, many American’s would probably describe our healthcare system in three, more or less, simplistic parts: The insurance company, the hospital or physician, and the patient. The patient gets care after paying into insurance, then the insurance company (hopefully) covers the cost when healthcare services are rendered.

But this is barely even a sliver in the whole healthcare pie. And it’s not particularly accurate.

The bad news, is that it’s much, much worse than we think.

First, let’s introduce the players…

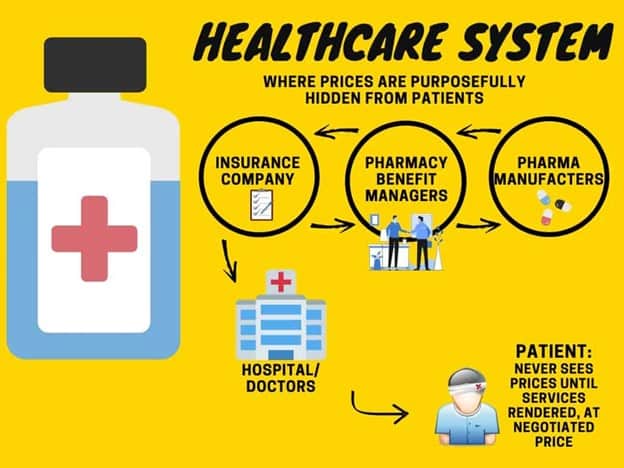

The Insurance companies, the pharmacy benefit managers, the pharmaceutical manufacturers and the hospitals.

The four horsemen of the healthcare Apocalypse.

Understand, first and foremost, that the current medical system is not free market medical care. In order for a free market to function, price transparency is a fundamental aspect of any transaction.

It’s only in our healthcare system that prices are purposefully obfuscated from the patient.

Every entity involved in the healthcare process is banking on the fact that you are kept in the dark as far as pricing is involved; that you won’t ask, and that you won’t rock the boat.

Here’s how these entities work:

Hospitals have a “chargemaster”, in their computer database. This is a master list containing every procedure, goods, and service they offer, with arbitrary prices that can change as often as they like.

These prices, which are hidden from patients, are exorbitantly raised, seemingly having no real basis in reality.

What the chargemaster does do, is give a point from which negotiations will begin with insurance companies.

You read that right: Prices are not actually set. They are constantly negotiated.

The higher the chargemaster is “set” for each service, the more wiggle room both the insurance companies and hospitals have to make a lot of money.

If you’re a more savvy patient who calls ahead and requests the price(s) for services via the chargemaster, good luck.

More often than not, patients who ask will suffer one of these fates: An obstinate worker who refuses the request, a hours-long hold-time, or a hangup tone.

If the gods smile upon you, sometimes an itemized list will be given, however, there’s always an asterisk; the price is never set, it remains an “estimate” until services are rendered, and the surprise bill comes your way.

Another reason for price obfuscation is contractual: Insurance companies, in their contracts with hospitals, forbid the divulging of prices to patients.

This is enough to make anyone’s blood boil.

Now, in regards to your insurance company and getting medications, this is another funny tango…

Another entity that has their hands in the healthcare pie is the Pharmacy Benefit Managers. This is a separate group who negotiates prices with the pharmaceutical manufacturers, ostensibly to bring down prices via refunds and rebates to be passed onto insurance companies and thus the patient.

Can you guess what happens instead?

Right. Although prices are brought down, much of the rebates and discounts aren’t passed on for patient savings, instead they’re pocketed by Pharmacy Benefit Managers. And they do hold the most poker chips in this game.

Why?

Because in order for a pharmaceutical company to get their prescription or device on an insurance company’s formulary- the list that details what is covered by insurance- Pharmacy Benefit Managers make sure they get the most rebates and discounts possible.

What good is a medication if the patient isn’t told of its existence?

The more a pharmaceutical company is willing to play ball, the higher on the formulary a medication or device is placed.

Now, some other fishy business happens in how pharmaceutical companies set their pricing with Pharmacy Benefit Managers:

Big Pharma justifies high prices for their products when they first hit the market, due to the extensive costs, risks, and long process required to research, develop, test and produce medications and devices for the market.

And they’re not all wrong.

On average, the time it takes to get a pharmaceutical from compound to shelves is 12 years. And the cost for the company for each new pharmaceutical is between $1 billion to $2.8 billion. Most people severely underestimate the time and cost of this process.

Developing pharmaceuticals and medical devices is a long, laborious, expensive process. And companies do need to recoup their money and turn a profit.

However, the current patent laws set a manufacturer’s patent length at 20 years. And there are other legal ways to extend this time by years, making it impossible for competing generics to get on market.

Generic competition is vital, as prices drop on average of 80% when generics are introduced. Without this competition on the marketplace, drug manufacturer’s can list some rather obscene prices leaving patients in the lurch.

Part III: So What Do We Do?

Even from this brief description of how the current healthcare system works, you can see how convoluted and highly controlled it is.

So, what do we do?

First, arm yourself with the knowledge of how the game is rigged.

Know that because prices are ultimately fictitious (in that they’re bloated to an obscene degree), they are always negotiable.

Negotiate: Ask your doctor directly, how much a service or procedure will cost if you “pay cash”. Legally, a doctor is not required to inform insurance companies of a cash-payment with a patient. And often, doctors will give a large discount if done this way.

While negotiating, a helpful guide to have on your phone is HealthcareBluebook. This is an app in which you input your zip code and the service you need, and like a Kelly Bluebook pricing system for vehicles, the Healthcare Bluebook will give you an approximation of prices in your area, color-coded, to indicate pricing considered Fair, slightly over-priced, or Unfair pricing.

The more tools and information you have at your disposal, the better.

Get Insurance. Having some form of insurance is just prudent. It only takes one surprise illness or accident to throw you into a financial mess. And if you’re a frequent traveler, this can make health insurance coverage squirrelly.

If you currently have health insurance, make sure you read the fine print of your agreement: Often, buyers don’t realize that they aren’t covered if out of state from their mailing address, or there’s a time-requirement clause stating one must reside in a state outside of their mailing address for a minimum of 6 months before the company will cover healthcare.

If you’re a traveler and plan on moving around the country frequently, a helpful site that provides health insurance, RV insurance, and Catastrophic Insurance coverage is RVer Insurance Exchange. Finding coverage to fit your lifestyle is important, and on RVer Insurance Exchange, they even offer “Telemedicine”- access to physicians 24/7 via your phone!

Free Market Medical Care. This is an interesting development in the last few years: Physicians and surgeons bypassing the mess of insurance companies and offering their services on the free market, offering price transparency, no surprise extra billings, no guesswork. Doctors join an online medical marketplace where they clearly post their prices for specific services. As a patient, you can peruse the prices and decide yourself whether or not to buy.

shophealth.ffma.org is free to look up the particular services you need, along with pricing, the physician’s location and bona fides. One major disadvantage is that there is a dearth of services on the West coast, especially California. Due to state regulations, doctors are finding it difficult to set up shop in the state.

Medibid is another site where physicians and patients can meet on the free market. Both doctors and patients sign up through the site, and patients post their need (whether it be a MRI, colonoscopy, hip replacement or heart surgery).

From there, physicians will post their “bids”; then it is up to the patient which bid they want to accept (if any). By following Medibid on Twitter, you can see physicians bidding for services and procedures in real time- total price transparency and true free market competition.

Cheaper Prescriptions. Prescription prices can often throw us for a loop, especially if we’re without insurance to help cover the cost. In fact, Twitter recently had a tweet go viral after parents had to pay over $175 out-of-pocket on Tamiflu for their sick daughter.

This is where the GoodRx app can come in handy.

It’s free to use, and gives you the cheapest prices it can find for the prescription you need in your local area.

The Tamiflu that cost that couple nearly $200, could have been found for less than $18 via GoodRx.

GoodRx does have it’s limitations: Prescriptions for rare, terminal or chronic illnesses may still be exorbitantly expensive (ie those with HIV who require specialized medicines won’t find much of a discount via the app, their monthly costs may still be over $1000. Insulin, another notoriously expensive medicine, will still run a patient over $100 on GoodRx).

However, it’s still worth a look: Compare prices to find the cheapest one near you. Sometimes, GoodRx prices will be cheaper than what it will cost with insurance!

And for someone on the road, having a mobile app where you can compare prices no matter where you are travelling, can be very helpful.

Get an Advocate. If you’ve found yourself in a stressful pit of unpayable medical bills, bill collector calls, and can’t see a way out, find a medical bill advocate.

These are people who specialize in the intricacies of the healthcare beast, and who can negotiate hundreds, thousands, or sometimes even hundreds of thousands of dollars off your medical bills.

Their specialty is helping those who find themselves in trouble when: Insurance refuses to cover a cost leaving the patient to foot the bill, when healthcare providers bill for ridiculous prices (often over charging or double-charging), or when patients are thinking of declaring bankruptcy due to medical bills.

Medical Bill Advocates typically charge per hour between $75-$200, but their services can alleviate much bigger bills on your plate.

Don’t try to fight the beast alone, there are specialists out there who are on your side and can help knock down some bills, easing your burden.

Citizen Xero does NOT use Google Analytics to track readers or earn money from Google advertisers. If you find these articles helpful, please consider donating to our Cointree to help keep this site running. We gratefully accept Bitcoin and PirateChain.

Recent Posts

Humanity is entering a strange new paradigm; one in which all the rules of the game have been upended. Bubbling to the surface of our zeitgeist are earnest discussions of society’s current...

Millions of people are buying Bitcoin and leaving the dollar behind in the dust bin of monetary history. From unending money printing, to the inflation to which it inevitably leads, to governments...