World governments are running off fumes of fiat funny money. In America, the current monetary system has been propped up only by the “full faith and credit” of the US dollar. This is one of the many reasons why Bitcoin will succeed.

Unlike fiat currencies, Bitcoin has all the features of a “hard money”, making it more valuable, desirable, and dependable than any other monetary system in humanity’s history. Bitcoin contains the following features: Decentralized blockchain technology, finite amount of coins, direct peer-to-peer [P2P] transactions, near-instant transaction time, unconfiscatable, borderless, no reliance on gatekeepers, easily transported, and has a transparent ledger for an honest monetary system.

First, let’s take a look at what Bitcoin is, then dive into each of these hard money traits to understand why Bitcoin is the answer to the problem of runaway monetary policies, corrupt governments, and a re-establishing of personal freedom.

What is Bitcoin?

Bitcoin (BTC) is the world’s first working decentralized digital currency. Created in 2009 by cypherpunk(s) under the pseudonym, Satoshi Nakamoto, Bitcoin was the genesis blockchain.

In essence, the Bitcoin blockchain is a chain of “blocks”. These blocks are filled with data. This data contains every transaction ever to happen on the blockchain, complete with timestamps and digital “signatures”, like a ledger. Each block of data relies on every single block before it, so new information (like transactions) can be added to the blockchain, but there can never be any retroactive changes.

Unlike the current world financial system, the Bitcoin blockchain is completely independent of centralized banks, or any governmental institution; Instead, it is a worldwide distributed system, without any central authority, which relies on a completely transparent network, without the ability to defraud the system.

Decentralized Blockchain

Unlike the fiat money system- a centralized behemoth in which all power is consolidated among a small group of banksters and corporations- Nakamoto’s vision was to decentralize the power of money creation and fiscal ownership, giving that power to anyone with a home computer.

Since it’s inception, people all over the world, on every continent, have been running individual computers which make the entire blockchain functional. It’s the most decentralized system ever created; More so than the internet itself.

With a decentralized currency, there is, as millionaire investor, Cathie Woods, stated, “No [central] throat to choke”. Bitcoin’s decentralized technology relies on millions of separate servers, running all over the world, leaving its functioning untouchable. The only true way to bring down the Bitcoin blockchain is to turn off the world’s internet, simultaneously, forever.

Barring that from happening, Bitcoin is, essentially, unstoppable. No government can stop it; there’s no single person running the blockchain, there’s no single person or group to raid or arrest. No bank can stop it; Bitcoin’s blockchain is running on every continent of the world by regular people and their legion of computers.

Bitcoin’s massive decentralized blockchain is ungovernable, uncancellable, unstoppable, and inevitable.

Finite

Another important feature of Bitcoin is the fact that there is a finite number of “coins” that will ever be produced. Fiat currency, in contrast, has an unceasing supply, debasing the dollar into mere “Monopoly” money. Governments and central banksters, have a nasty habit of printing trillions of dollars in order to pay for endless wars, prop up wasteful policies, and engage in unbridled corruption; And with each pull of the printing press lever, the cesspool grows larger, while the dollar retains less and less value.

Bitcoin fixes this.

In Bitcoin’s algorithm, there is no way to produce any more than 21 million BTC. Once those are mined on the decentralized servers, all that remains is the ability to save or spend BTC. No corrupt government or bank can wield power over the system, no extra money can be created out of thin air, and BTC’s value cannot be inflated or devalued as it is with every fiat currency.

Peer-to-Peer [P2P], Borderless Transactions

Unlike every other digitized transaction- whether it’s debit, credit, PayPal, Venmo, wire transfers, or checks- Bitcoin does not rely on gatekeepers which control any aspect of commerce. Indeed, bitcoin is directly Peer-to-Peer (P2P), transcends borders, and requires no third-party permission for transactions to take place.

Regardless of where BTC users are in the world, a transaction can happen in the course of minutes, with no central authority to prevent, slow, or otherwise interfere in the transaction.

With Bitcoin, you are your own bank.

For foreign workers sending remittances to family members in their home country, relying on bank wire transfers are not only expensive- eating at least 5% of the amount sent- but also forces dependency on central banks. The ability to send wire transfers depends on limited bank hours, processing time, as well as their exorbitant fees.

With Bitcoin, remittances are easily sent (and settled) to family members in other countries, near-instantaneously, without predatory fees to do so.

Unconfiscatable

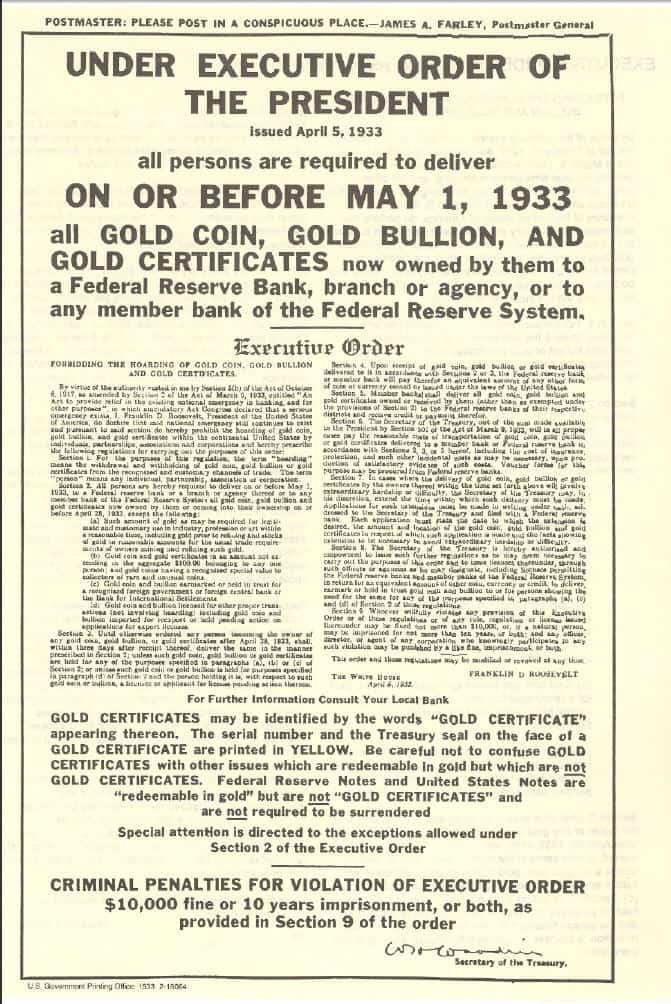

Gold, fiat, credit cards, bank accounts- all can be, and have been, confiscated at some point. And it’s not just your run-of-the-mill street thief, or “cancel culture” payment processing closure; As recently as 1933, the United States shook down citizens and stole all their gold. Using the Great Depression as a means to write new legislation in order to confiscate the country’s gold, the Federal government passed the Emergency Banking Act of 1933.

Franklin D. Roosevelt took the liberty of forcibly closing private banks for days, then confiscated gold and silver coins, bullion, and another forms of the currency from US citizens. At the time, Senator Bertrand H. Snell advocated for the theft, stating, “The house is burning down, and the President of the United States says this is the way to put out the fire… there is only one answer to this question, and that is to give the President what he demands and says is necessary to meet the situation”.

So the Federal government stole gold from its citizens (who sold under duress, as they faced penalties of $10,000 fines and ten years in jail), and once the government held most of the precious metals, the government increased the price per ounce.

Neat trick. But Bitcoin fixes this, too.

Blockchain currency requires “seed phrases/keys” to access one’s crypto. This is often a 12-24 strong of random words. Many Bitcoin holders choose to memorize their seed phrase (so no one else could ever access their coins), and/or put them on encrypted usb drives.

Unlike gold and other tangibles, Bitcoin is the one store of value that cannot be confiscated.

Near-Instant Transaction + Settlement Time

Although traditional methods of digital payments, like debit payments online, feel as though they are instantaneous, they are not.

From the time an online purchase is made, for example, it can take anywhere from a few hours to more than three business days to clear the transaction with the bank.

Bitcoin settles transactions in minutes [on Lightning Network].

Easily Transported

Bitcoin is stored on the blockchain, and accessed in a number of ways: On a home computer, portable laptop, cell phone, or paper wallet. Every Bitcoin holder should have a cold wallet; Remember:

Not your keys, not your coins.

In recent years, Bitcoin has gained the attention of some of the world’s wealthiest people, from Elon Musk to Michael Saylor, who have christened BTC “digital gold”. Regardless of this new perception being accurate or not, comparing BTC to gold is somewhat apt; Gold is a store of value, but is notoriously difficult to transport. The weight, volume, and cumbersome nature of moving gold as payment or to store is a true deficiency. Bitcoin, on the other hand, is stored on the blockchain, and accessible via mobile devices, pieces of paper, cold wallets, or home devices, and can be sent to another wallet effortlessly, without any extra planning or logistics.

It’s as easy as scanning a QR code, or entering a wallet number.

Transparent Ledger

On Bitcoin’s blockchain, the ledger which records all transactions ever made, is transparent. This means, that although the wallets are pseudonymous (wallets have codes, but no names attached), every transaction can be easily seen and tracked by anyone.

This is a double-edged sword.

Having a transparent ledger is deleterious to the average citizen, as governments, banks, business competitors, jealous family members, or corrupt institutions are able to see how much BTC someone has in their wallet, where they spent it, et cetera. Once private financial activities are now public- to the entire world. The privacy of citizens and the right to business is sacrosanct, and needs protection, not a panopticon.

On the other hand, transparent blockchains are a boon to reigning in corrupt government spending, money laundering among the world’s elites, and stopping the extensions of such deceit- like endless wars, bribery, and the exploitation of ‘disposable people’.

Governments and institutions could no longer rely on the “Fed” for a never-ending supply of fiat currency, nor could they continue to tax- at increasingly higher rates- the People. Every Bitcoin is accounted for on the transparent ledger, every transaction, and wallet is visible. If adopted, governments would either have to resort to honest money keeping, or their power would no longer be seen by most as legitimate.

Final Thoughts

Bitcoin will succeed because its time has come. Money is simply a tool, regardless of form, so long as the masses adopt its general usage. Humanity has utilized cowrie shells, stones, gold coins, paper dollars, and now, digital code, as money.

Until now, all societies were limited by the financial confines which they’ve been yoked: Centralized banks’ fiat currency. But with the advent of Bitcoin’s blockchain technology, we have a real opportunity to “clean house”, and revert back to a “hard money”; One that no longer allows wild, deceptive government spending, and cannot be used as an inflationary weapon against the People.

In the end, Bitcoin wins.

Citizen Xero does NOT use Google Analytics to track readers or earn money from Google advertisers. If you find these articles helpful, please consider donating to our Cointree to help keep this site running. We gratefully accept Bitcoin and PirateChain.

Related Posts: How to Buy Bitcoin Anonymously

Bitcoin Is For Criminals [+ 5 Other Myths]

Recent Posts

Humanity is entering a strange new paradigm; one in which all the rules of the game have been upended. Bubbling to the surface of our zeitgeist are earnest discussions of society’s current...

Millions of people are buying Bitcoin and leaving the dollar behind in the dust bin of monetary history. From unending money printing, to the inflation to which it inevitably leads, to governments...