For newcomers flocking to Bitcoin, there is no shortage of myths muddying the waters.

As Bitcoin enters the mainstream, it’s surrounded by a shadow of prevalent myths: from its sole use being for black market “dark web” deals, to being a flash-in-the-pan Ponzi scheme, and everything in between.

So, to set the record straight, let’s dispel the most common Bitcoin myths.

1. Bitcoin is for Criminals (and it’s Anonymous)

One of the most enduring myths about Bitcoin is that it’s the chosen currency of criminals and other shady characters. This perception took root after the sensationalized story broke about the dark web site, Silk Road.

Bitcoin was the method of payment on the Silk Road, a site which sold nearly everything, including drugs and firearms. Promoted as an untraceable, anonymous digital currency by both the runaway media and bad government actors, Bitcoin became synonymous with illegality.

But illicit activities are rarely funded by Bitcoin; Every transaction and digital wallet is visible on the blockchain. Bitcoin is neither untraceable nor anonymous; In actuality, it’s pseudonymous, with all transactions viewable to anyone, including each coin’s genesis to all subsequent debits and credits. In many ways, it’s the worst currency to use for illegal activities because it’s so easily traced.

But the same cannot be said for the US dollar.

Indeed, the US dollar is the most used currency among criminals around the globe. Long before Bitcoin hit the scene, the dollar has been the currency du jour of drug cartels, human traffickers, money launderers, and corrupt governments.

Instead of being the problem, Bitcoin is actually a solution.

2. Bitcoin Isn’t “Real” Money

Bitcoin- the original cryptocurrency- was created with the explicit purpose of being “a purely peer-to-peer version of electronic cash [that] would allow online payments to be sent directly from one party to another without going through a financial institution”.

Bitcoin is digital money. It’s often said: Bitcoin isn’t money for the internet; Bitcoin is the internet of money.

And what is “real” money?

“Money” is most often defined by the following features: A store of value, a unit of account, and a medium of exchange. Throughout history, civilizations have used mollusk shells, cattle, leather, precious metals, and paper as money. During their respective times, each satisfied the three features of “money”, with societies agreeing to their use as acceptable currency.

Today, the US dollar is fiat; Meaning, there is nothing backing the dollar’s value but the “full faith and credit” of the United States… Our money is backed by trust.

There was a time when the dollar was backed by gold; This protected against perpetual money printing and the following inflation. But, by 1971, the US was taken off the Gold Standard, and what was left was paper-based “Federal” Reserve notes. The world is literally running off of the equivalent of Monopoly game board money, but the scam is perpetuated by a corrupt system, and upheld by the Peoples’ ignorance and belief in the scheme.

In reality, Bitcoin is “harder” money than the US dollar, or any other fiat currency. For a detailed explanation on why this is true, read Why Bitcoin Will Succeed.

3. CBDCs are Better Than Bitcoin

Central Bank Digital Currencies (CBDCs) are anathema to the philosophical foundation of Bitcoin. Unlike Bitcoin, CBDCs are centralized, meaning all power remains with the central banks; They’ll have the power to digitally control how, when, where, and on what, an individual spends their own cryptocurrency. Central banks would have unlimited control of individuals and the economy- essentially creating a panopticon, an escape from which would be difficult, if not impossible.

Don’t get suckered into the central banks’ attempts to co-opt cryptocurrencies: Their CBDCs are meant to ensure their control by perpetuating the same fiat system they’ve had for over a century; But, with CBDCs, the situation would prove even more dire for individual freedom as the central banks would not only retain the same “authority” to create money out of nothing, but also gain complete and total access to every person’s finances.

Conversely, Bitcoin is the most decentralized system ever created. The power of commerce remains with the individual, as millions of mining computers continuously run to maintain the blockchain, and there is no gatekeeper that can prevent any transaction from anywhere in the world. Not only that, but Bitcoin is “harder” money than any fiat system, regardless if that fiat is based on unlimited paper printing, or inputting unlimited digits in a centralized computer.

4. Bitcoin Hurts the Environment

Politicians, central bankers, and even Elon Musk, espouse concern over Bitcoin’s energy usage. Bitcoin relies on millions of independent computers worldwide in order to maintain its decentralized blockchain system and complete hashes (computations) for the ledger. Yes, this requires immense energy, but the FUD (“Fear Uncertainty and Doubt”) poured on Bitcoin in regard to its eco footprint is unfounded. In actuality, Bitcoin’s energy consumption “requires less than 1% of the energy that idle electronics in just the US consume”.

It’s certainly not the environment-killing, energy behemoth certain players would like you to think it is.

In reality, over 40% of crypto mining is “green”, as it behooves miners to move toward environmentally-friendly options like solar and hydroelectric. He who uses the cheapest, renewable energy reaps the most profit.

When El Salvador began accepting Bitcoin as legal tender alongside the US dollar in September 2021, forward-thinking President Nayib Bukele boasted his country’s renewable energy source: Volcanoes. In a Tweet, Bukele said:

“I’ve just instructed the president of @LaGeoSV (our state-owned geothermal electric company), to put up a plan to offer facilities for #Bitcoin mining with very cheap, 100% clean, 100% renewable, 0 emissions energy from our volcanos. This is going to evolve fast!”

So, before you believe all the FUD, do your own due diligence: Research Bitcoin’s true energy costs, miners’ cost-benefit analysis, and be wary of the motivations behind corporate powers and central bankers attempting to lure you away from Bitcoin.

For more on Bitcoin + Energy, check out EndTheFud.org

5. Bitcoin Has Been Hacked Multiple Times

Bitcoin’s blockchain has never been hacked; It’s the most secure, decentralized, open-source system ever created. The algorithm which runs via the millions of worldwide servers checks for any rogue commands or transactions, and bars any from taking hold.

What has been hacked are the exchanges which people use as custodians of their crypto. When crypto owners leave their coins on an outside exchange, there’s a high chance that, eventually, the site will be hacked and the crypto will be stolen. There’s a litany of hacked sites which include: Mt. Gox, Coinbase, Bitpoint, Poloniex, Uniswap, and a slew of others. Since Bitcoin’s inception, roughly $1 Billion has been stolen through exchanges.

Bitcoiners should never keep coins on an outside wallet (“custodian wallets”); Always have a cold wallet like a Ledger, Trezor, or SeedSigner to maintain full control over your coins.

6. Bitcoin is Just a Fad

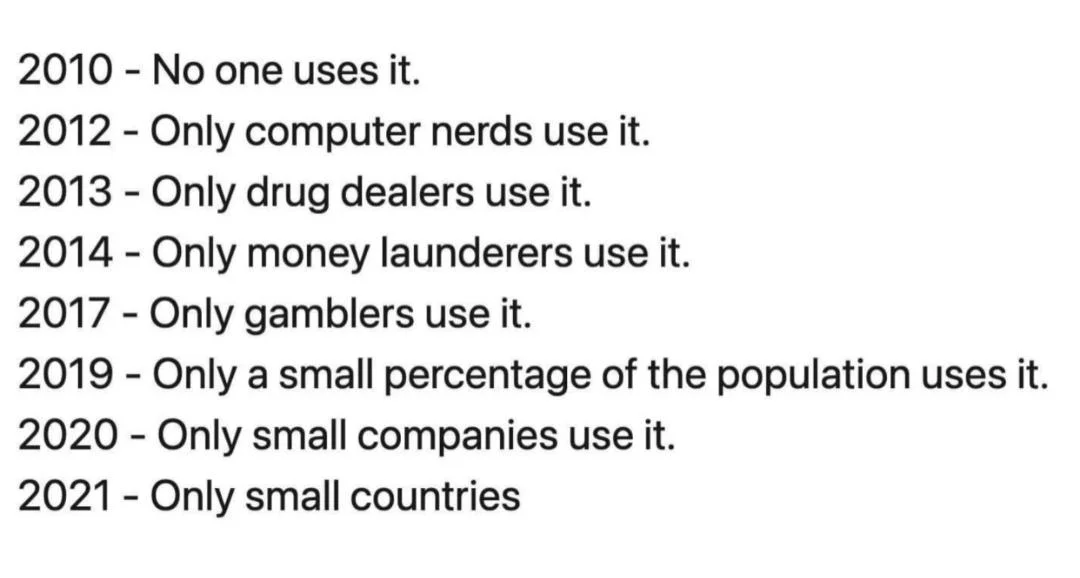

When Bitcoin first came on the scene in 2009, only computer nerds and Libertarians were interested in its potential. BTC’s price was a measly $0.003 per coin, and its future as a legitimate currency was uncertain. Now, over 14 years later, Bitcoin has reached heights of $20,000 per coin and shows no sign of stopping.

Although central banks and corporate media have tried to claim “Bitcoin is Dead“, it’s become more decentralized- and thus, more powerful- than anyone could have predicted. Initially, use cases for Bitcoin were limited: Cups of coffee at Libertarian festivals, or an online Pizza-buying agreement for 10,000 BTC.

But times have changed.

Since its modest beginnings, Bitcoin is now poised to change the face of finance, government, and will likely upend the structure of world societies. The first domino to fall to Bitcoin was El Salvador, and its acceptance of BTC as legal tender in September of 2021. Panama, Argentina, and others are now considering following suit.

Bitcoin isn’t going anywhere. It’s not a “fad” for computer nerds; Its a world-changing digital currency which stands to disrupt the old guard.

Wrap Up

For those new to the concept of Bitcoin, it’s hard to sift through the immense amount of information available, let alone recognize the most pervasive myths.

Regardless of the FUD which has followed Bitcoin since its start, it’s not the chosen currency of shady criminals in the underground, nor is it an earth-destroying, flash-in-the-pan scam.

In reality, Bitcoin is the ultimate “hard” money: An open-source, decentralized system which gives financial sovereignty back to the individual.

Citizen Xero does NOT use Google Analytics to track readers or earn money from Google advertisers. If you find these articles helpful, please consider donating to our Cointree to help keep this site running. We gratefully accept Bitcoin and PirateChain.

Recent Posts

Humanity is entering a strange new paradigm; one in which all the rules of the game have been upended. Bubbling to the surface of our zeitgeist are earnest discussions of society’s current...

Millions of people are buying Bitcoin and leaving the dollar behind in the dust bin of monetary history. From unending money printing, to the inflation to which it inevitably leads, to governments...