At its inception in 2009, buying Bitcoin was, essentially, anonymous to buy and pseudonymous to use. Now that the Bitcoin network has had over a decade to grow, KYC [“Know Your Customer”] requirements are making privacy more difficult to obtain and maintain.

But, there are still a few ways to protect your privacy while onboarding to the Bitcoin blockchain:

- Bitcoin ATMS + pre-paid phones

- Bisq [open-source software]

- Mining

Bitcoin ATMS and Pre-Paid Phones

Buying Bitcoin with your privacy in mind can still be done using a pre-paid phone and Bitcoin ATMS:

Step 1: Get a Pre-Paid Phone

Buy a pre-paid phone and load it with minutes: Read this Reddit post. Once you have your phone set up, it’s time to purchase a cold wallet [also called a hard wallet].

Step 2: Purchase a Cold Wallet

Now you’ll need to purchase a “cold” wallet. This is a device that will allow you to hold, access and transact in Bitcoin, while keeping your identity private.

Never use a centralized exchange to buy/keep your Bitcoin- they function more like traditional banks and require identifying KYC (“Know Your Customer”) information like a photo ID. Centralized exchanges have also had their fair share of hacks; So, never keep your BTC in these custodial wallets.

There are plenty of cold wallets on the market, two of the most popular are the Ledger and the Trezor. I suggest the Ledger Nano X, for its design, functionality, and ease of use.

Never buy a cold wallet anywhere but directly from the company. Scammers are everywhere, and if you think you’re getting a better deal by purchasing a cold wallet on Amazon or Ebay, what you’re really getting is a high probability of a pre-used device… one in which the seller still has access. Plenty of newbie Bitcoin buyers have woken up only to find it all gone- Disappeared into someone else’s wallet. If this happens, you can kiss those “bits” goodbye. There’s no getting them back once taken.

Step 3: Wallet Set Up + Seed Phrase Storage

Set up your cold wallet device, connect to the accompanying software, and hide your seed words/phrase. If you have a Ledger, watch this tutorial on how to set it up. If you have a Trezor, watch this tutorial.

While setting up your cold wallet, make sure to properly store your seed phrase/words: These are your “private keys”. Your private keys are what gives you, and you alone, access to your Bitcoin if you lose your cold wallet, or run in to software problems and need to restore your wallet. Private keys are your only way to salvage your coins when something goes wrong.

Not your keys, not your coins

Keeping them safe and private are essential to holding valuable currency. There are many methods of safekeeping, including the Ledger Crypto Steel (highly recommended), a solid steel case, steel stamping kits, and encrypted USBs (also highly recommended).

It’s a good idea to have your seed phrases stored on more than one of the above methods, as well as keeping them far away from your computer (ie a family member’s house, or a safe deposit box). Once you have your cold wallet set up, and your seed phrase stored, make sure to copy/save your wallet’s receiving address (this is where you’ll send the Bitcoin). When you have this, it’s time to move on to Step 4.

Step 4: Find a local Bitcoin ATM

Use a Bitcoin ATM finder, like CoinATMRadar.com, to locate BTC machines in your area. CoinATMRadar provides general information such as: What cryptocurrencies it sells, additional fees, and what identifying information is required for purchases.

Make a list of all the local ATMs that only require SMS phone number (you’ll get a verification text code on your pre-paid phone) to access the ATM. Some machines will require full KYC, including your driver’s license; Stay away from these if you’re looking to maintain your privacy.

Bitcoin ATMs typically have a range of purchase tiers, each amount requiring different forms of identification. For instance, an ATM may have a $1-$750 range which only requires SMS approval, but $751-$1500 will require full KYC.

Sometimes the websites aren’t updated, so when you get to an ATM on your list, you may find that it now requires KYC. Take that off your list and try the next one.

Step 5: Purchasing Your BTC

Make sure you have your pre-paid phone, BTC receiving address, and cash when you get to an ATM. From here, you’ll follow the machine’s directions, input your cash, and keep the receipt (check your Bitcoin account to make sure the funds arrived). Here is a general tutorial on how to use a Bitcoin ATM. Know that these ATMs come in a variety of shapes, sizes, and interfaces, but they generally follow the same steps.

Bisq

Bisq is a DAO (“Decentralized Autonomous Organization”); meaning, instead of a website or app controlled by a few people, Bisq is a decentralized software program than anyone can run on a computer, and trade directly from peer-to-peer (P2P) without any intermediary.

On this decentralized exchange, there are no coins stored; All trades are done between the participants. On Bisq, users can trade fiat currency for BTC, BTC for other BTC, and even Amazon gift cards for BTC.

One downside is the learning curve: Users need to learn the interface, and for those who consider themselves less than computer savvy, the process can feel intimidating. A helpful how-to tutorial on using Bisq can be watched here.

Meetups: In-Person

Purchasing Bitcoin in-person is another option. Bitcoin meetups are happening in cities everywhere in the world; They are a great way to socialize with like-minded people, as well as “stack some sats”. Most Bitcoin transactions are done over the Lightning Network [due to its ease of use and low fees], so make sure to have a LN-wallet on your smartphone like Wallet of Satoshi or Blue Wallet. From there, bring some cash, and if someone is looking to sell any sats, you can easily buy some.

Mining

Mining is the OG option of earning Bitcoin anonymously. “Mining” refers to the process of computers verifying the blockchain’s transactions and helps to upkeep the system; miners are rewarded with Bitcoin].

In order to set up a mining rig, you’ll need to invest in the following:

-Motherboard

-CPU (Central Processing Unit)

-Storage

-PSU

-PCI-e Riser

-Graphics Card

In general, it will take an upfront investment of $2,000 to $10,000 to set up a Bitcoin rig capable of earning BTC. For a tutorial on how to get started, watch this video.

Or…

For those who aren’t tech-savvy and prefer a simple plug-n-play Bitcoin mining option, small, pre-built rigs like a coinmine are available.

A Word of Warning: Once upon a time, mining was highly profitable endeavor; early Bitcoin enthusiasts could run a home computer and stack sats. However, due to its massive growth since its inception in 2009, Bitcoin mining has grown exponentially, with large mining farms running thousands of mining computers. DIYer’s home computers are little match for that kind of computational power.

Mining, for the home enthusiast then, is better seen as an individual’s way to help decentralize the system even more and maintain the strength of the network; An important aspect of what makes Bitcoin special. The work, however, won’t earn much- and may even cost more in electricity than what is possible to mine in BTC.

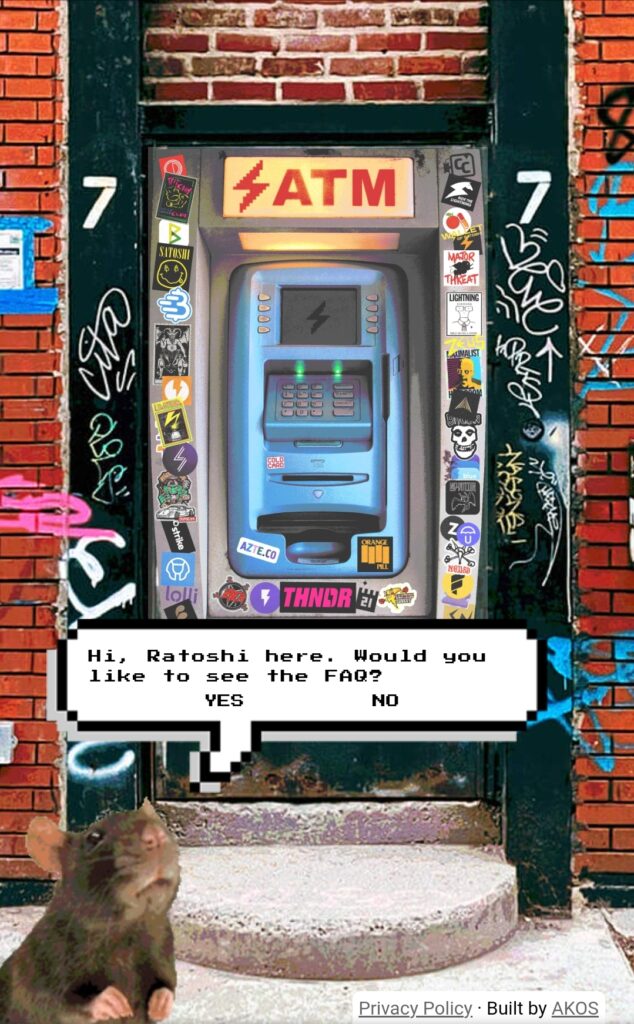

RATOSHI’S LIGHTNING ATM

Lastly, you can stack some sats from the streets with Ratoshi and his Lightning ATM- a little internet gem. Press “yes”, read the FAQs: https://atm.lightning.store]

WRAP UP

Take advantage of the various ways of getting Bitcoin, from pre-paid phones, to DAO’s, at-home mining [or even on the streets with Ratoshi], while guarding privacy and retaining anonymity.

Remember:

Privacy is vital to all free people; Without it, we are rendered perennially, surveilled chattle.

This includes the right to transact privately with each other, directly peer-to-peer, without surviellance.

Citizen Xero does NOT use Google Analytics to track readers or earn money from Google advertisers. If you enjoy what you read, please consider donating to Cointree [Bitcoin or Pirate Chain].

Related posts: Why Bitcoin (and Crypto) Will Succeed

Why Bitcoin Will Kill the Central Banks

Recent Posts

Humanity is entering a strange new paradigm; one in which all the rules of the game have been upended. Bubbling to the surface of our zeitgeist are earnest discussions of society’s current...

Millions of people are buying Bitcoin and leaving the dollar behind in the dust bin of monetary history. From unending money printing, to the inflation to which it inevitably leads, to governments...