Pull out a dollar bill and take a look at the front. Notice the top banner reads: “Federal Reserve Note”. Although it seems innocuous, that piece of paper, with those printed words, is a display of the biggest scam ever perpetuated on the world: The Federal Reserve’s Fractional Reserve Banking. And the only solution to this large-scale fraud is Bitcoin.

Here’s why…

Fractional Reserve Banking and You

In 1913, central banks were given control of America’s monetary system. Quietly signed into law two days before Christmas, the Federal Reserve Act centralized the nation’s entire banking system, putting private bankers at the helm of money creation and control.

Centralizing a nation’s money- placing it all in the hands of private bankers and elites- is deleterious to any country; For allowing any centralized power to enact control over a population through inflation and deflation enslaves them in perpetuity.

What the private bankers devised was immensely clever in its simplicity, and perverse in its machinations; What they implemented was Fractional Reserve banking using fiat money. This system’s basic equation is:

Money = Debt and Debt = Money

Every single dollar in existence- without exception- is already owed to the central bank, with interest. And all the money in existence could never pay off the original loans to which it’s attached.

Here’s how it works:

Let’s suppose the United States government needs money. Their first call is to the Federal Reserve Bank. Remember, the Federal Reserve is “Federal” in name only- a clever moniker to be sure- but regardless of what they’ve christened themselves, it is a private bank nonetheless.

So, the US government calls the private bank- the “Federal” Reserve- and requests $10 Billion. The Fed obliges, and in exchange for the $10 Billion loan (with interest), the Fed purchases US government bonds valued at $10 Billion. Once the exchange is complete, the US government deposits the loan into banks.

Now, out of nothing, money has been created and injected into the economy. Every dollar of that $10 Billion now has interest attached, that must be repaid to “the Fed”.

There are two main reasons why creating money out of nothing is possible: First, the currency of the United States is no longer backed by anything of value. Prior to 1933, gold backed the US dollar, however, after President Roosevelt’s confiscation of citizens’ gold, and taking the country off the Gold Standard- then in 1971, Nixon hammering in its final death knell- value of the dollar has been predicated on the mere “full faith and credit” of the US government. It’s funny money. It’s fiat.

Additionally, the creation of money out of nothing is made possible as the “Federal” Reserve- who was given control of the nation’s money supply in 1913- deems it so.

Now, back to the new $10 Billion that’s been deposited in the bank:

Banks are required to hold a certain percentage of the funds in their ‘reserve’- typically 10%. The rest is to be loaned out. So, in this example, $10 Billion was deposited, $1 Billion will stay in the bank’s reserve, and the rest- $9 Billion- will enter circulation.

Except, in realty, it won’t.

In reality, when the bank makes a loan- say for $9 Billion- the money doesn’t come from the initial deposit of $10 Billion. Instead, the bank keeps the initial deposit, and requests another Fed loan to dole out to the new debtor. So, the bank now has $10 Billion, and loans out an additional $9 Billion, totaling $19 Billion in the money supply.

When that new debtor gets their loan, they’ll more than likely put it in their own bank account. From there, the Fractional Reserve cycle starts anew: From the $9 Billion deposited, 10% is kept in the bank’s ‘reserves’, the Fed is tapped to send the bank more computerized digits as a new loan to a new debtor, 90% is loaned out. Ad infinitum.

| Reserve Based Loans | Money Supply Expansion |

| $10,000,000,000 | $10,000,000,000 |

| $9,000,000,000 | $19,000,000,000 |

| $8,100,000,000 | $27,000,000,000 |

| $7,290,000,000 | $34,390,000,000 |

| $6,561,000,000 | $40,951,000,000 |

| $5,904,900,000 | $46,856,000,000 |

| $5,314,410,000 | $52,170,000,000 |

| $4,782,969,000 | $56,953,000,000 |

| $4,304,672,100 | $61,258,000,000 |

This is the “Federal” Reserve Bank’s never-ending cycle of money creation and debt. Money = Debt, and Debt = Money

With every new loan a bank makes, the Fed creates more money out of nothing, with interest attached. If every dollar of every loan was paid off at the exact same time, there would be no more money in circulation, but money- in the form of interest- would still be owed to the central bank.

Inflation and You

So, why is a private bank’s ability to create money from nothing- with interest– and its subsequent injection into the economy so destructive to a nation?

Because private banks have unrestricted power, carte blanche, to manipulate the nation’s money supply through inflation. With every newly manufactured dollar pumped into the economy, the value of previous circulating currency is diminished.

Availability of goods and services in an economy are determined by supply and demand; but the continued addition of dollars, which outpace the normal ebb and flow of supply/demand, create the conditions in which prices keep climbing, while the dollar’s purchasing power plummets.

Since the Federal Reserve’s establishment in 1913, the US dollar’s value has rapidly declined, and is now worth 97% less than it was little over a century ago.

The more money you have, the less it can buy.

With the Federal Reserve system still in place, there is no way in which an economy can survive over a long period of time, and remain viable. As money injection continues, so too does the debasement of the nation’s currency; Purchasing power degrades to untenable lows, and inflation takes hold.

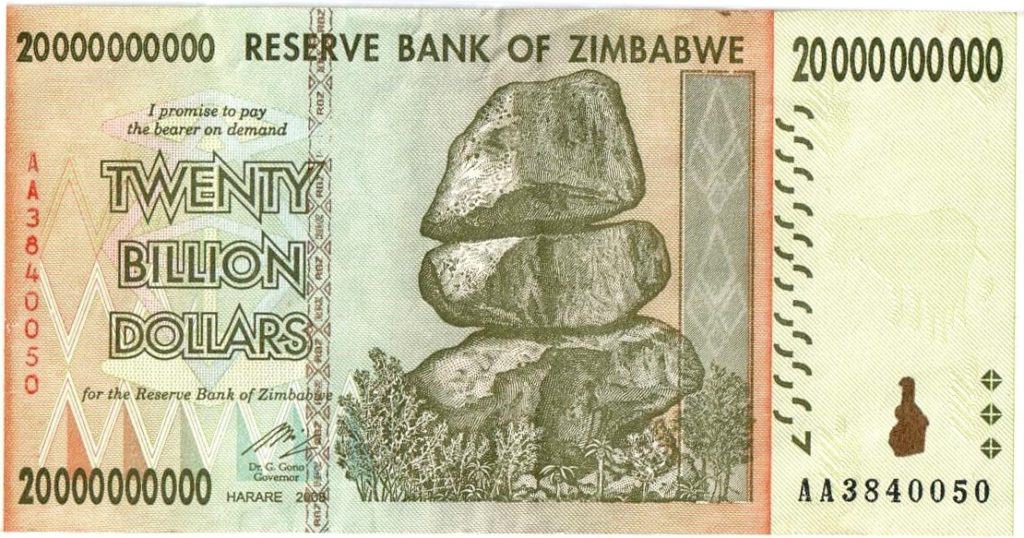

Many other countries have found themselves in the grip of hyperinflation: Germany after World War II (during which money became so worthless, people would use currency to paper their walls), Venezuela (where $150 will buy one dozen eggs), and Zimbabwe (where money is so debased, people fill wheelbarrows with their currency to buy a can of beans).

Until now, there has been no solution to the problem of the Fed. Certainly, a multi-trillion dollar, unstoppable private institution will never relinquish control of the countries which they now own through the tether of unending debt.

But no one anticipated the escape hatch. No one expected Bitcoin.

Why Bitcoin Will Kill the Central Banks

For at least a century, central banks have enjoyed monopolistic power over the money supply of nations. Such concentrated, centralized power comes at great cost to the people living under economic policy shaped by the manipulation of fiat currency.

Unlike the fiat money central banks have grown so accustomed, Bitcoin is the most honest, “hardest” money humanity has ever had. As central banks print fiat with abandon- destabilizing economies and nations- Bitcoin is the most sane monetary option.

With a new contender in the monetary ring, it becomes clear why the future of the central banks’ fiat scam looks grim:

Infinite Money

Fiat money is now based on nothing more than the “full faith and credit” of the United States. Once the Gold Standard was removed from the equation, the central banks have had total control of unlimited money creation, thereby continuously debasing the currency.

Bitcoin fixes this.

Bitcoin is limited to the creation of 21 million BTC; There can never be any more made, thus keeping inflation at bay.

Centralized

As the name implies, central banks retain centralized, monopolized power on the money supply. From the nunber of loans given, to the interest rates set, central banks have maintained a century of unfettered monetary manipulation.

Bitcoin fixes this.

Bitcoin is the now the most decentralized system ever to exist. Miners all over the world, on every continent, are supporting BTC’s blockchain functionality powered by millions of computers. Bitcoin’s open source algorithm runs without a middleman; no one has the ability to take control of the system or manipulate the currency.

With Bitcoin, the gatekeepers are gone, and the central banks are powerless.

No Accountability

Having the sole ability to manipulate money and markets allows central banks to operate with impunity. When inflation devalues currencies and upends stability, the central banks’ response always serves their self interest, and no other regulatory body will ever have enough power (or the will) to meaningfully penalize the organizations responsible for monetary destabilization. Central banksters are the wolves guarding the hen house.

Bitcoin fixes this.

Accountability is built into BTC’s blockchain: Bitcoin is mined, not capriciously created by- and for- debt creation. The amount of Bitcoin that exists is set, and cannot be inflated to drive the desires of any one person or group, regardless of how much power they once held in the old fiat paradigm.

Corruption

Money manipulation is but one arm of the central banks’ power. Another appendage is that of worldwide corruption born from unceasing government loans, which in turn, use those loans to fund the ever-hungry war machine.

Trillions of dollars are spent on the military industrial complex: Troops, tanks, bombs, jets, tactical equipment, bribes… All funded by central bank loans given to insatiable, belligerent governments, who retroactively tax the people in order to pay for wars never meant to be won.

Bitcoin fixes this.

When fiat currency loses its value, and Bitcoin rises in its stead, the entire paradigm changes. Ferocious money printing will cease as the dollar becomes powerless: World governments will stop accepting fiat, instead, preferring currency which retains its value.

Then the Jenga tower collapses.

Instead of pulling out trillion dollar loans, then writing laws ex post facto with the sole purpose of taking more money from tax payers in order to pay off said loans, governments will be forced to rely on the consent of the People once again.

Bitcoin is unconfiscatable, and no government can compel payments as it can with the current fiat system. Once the money printer slows, and the government becomes dependent on Bitcoin payments, it will have to work within a finite paradigm. There will no longer be money printed at will, at the behest of central bankers or world governments. Instead, the power will lie with the People, and their voluntary funding of government programs.

Wrap Up

For over a century, central banks have had control of the world’s monetary system. Through fractional reserve banking, these institutions have manipulated nations’ currencies through inflation, creating a precarious economic paradigm for all under their thumb.

Not until Bitcoin was there an escape hatch.

With the world’s most decentralized blockchain system, Bitcoin is poised to change the face of economics and governments, harkening in more honest systems. BTC solves fiat’s major problems, such as: Infinite supply, centralization, lack of accountability, and corruption.

Never in the history of humanity has there been a “harder” currency, one which supports the sovereignty of the individual, and degrades the power of the elites.

Central banks have met their match.

Citizen Xero does NOT use Google Analytics to track readers or earn money from Google advertisers. If you find these articles helpful, please consider donating to our Cointree to help keep this site running. We gratefully accept Bitcoin.

Recent Posts

Millions of people are buying Bitcoin and leaving the dollar behind in the dust bin of monetary history. From unending money printing, to the inflation to which it inevitably leads, to governments...

We are cursed to live in interesting times. Two decades into the 21st century, and everything is shifting under our feet: Technology is rapidly evolving, governments are vying for more power,...